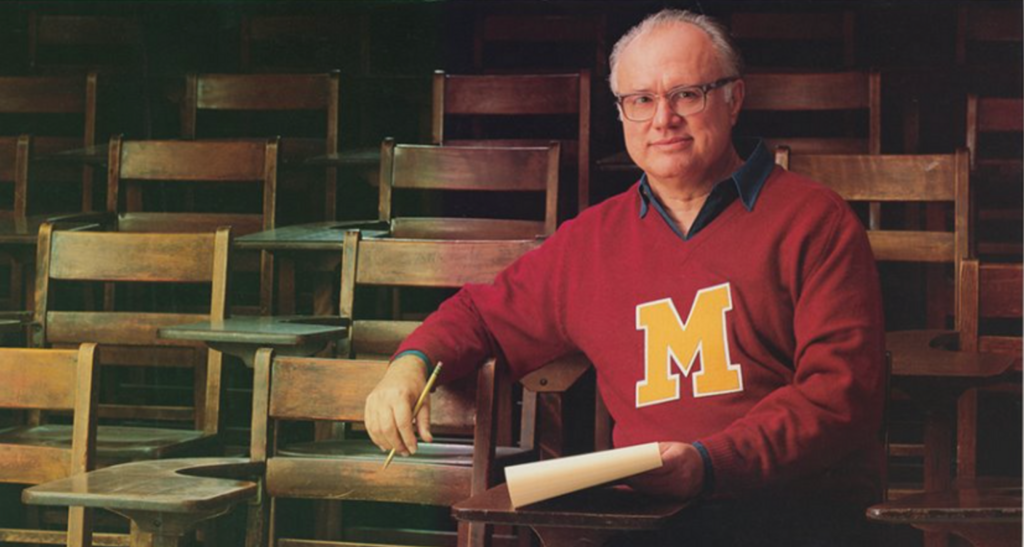

Dick

Richard “Dick” Morley | December 1, 1932 – October 17, 2017 | A college dropout, inventor, engineer and futurist whose work laid the foundation for modern industrial automation. As the father of the programmable logic controller (PLC), he fundamentally changed the way machines were controlled in manufacturing and industrial settings. His contributions made automation more adaptable, programmable and scalable, replacing the hardwired relay based control systems of the past. Morley’s work paved the way for modern industrial automation, allowing factories, assembly lines and complex manufacturing systems to function with efficiency, reliability and precision.

But Morley was more than just an engineer. He was a thinker who believed in pushing boundaries and questioning assumptions. His contributions to industry extended beyond PLCs. He played a key role in advancing artificial intelligence, digital manufacturing and industrial networking long before these fields became mainstream. He understood that technology should not be static but should evolve alongside human ingenuity.

This project carries his namesake because it embodies the same spirit of exploration and technological evolution that Morley himself championed. While PLCs have changed the way machines followed instructions, blockchain has the potential to change how machines interact, transact and govern themselves autonomously. Just as Morley’s PLCs transformed manufacturing, this project aims to redefine the relationship between industrial automation and decentralized computation.

Morley Labs

Morley is initially a framework for bringing Ladder Logic based automation to blockchain. It allows engineers and automation professionals to write, test and deploy machine logic as smart contracts on Cardano, providing an auditable, deterministic and decentralized execution environment.

By compiling Ladder Logic into Plutus Core, Morley extends traditional industrial automation with blockchain based security, transparency and reliability. This enables use cases such as machine driven financial transactions, automated compliance enforcement and on-chain verification of industrial processes. All while maintaining the familiar structure of Ladder Logic programming.

Morley does not seek to replace existing automation tools but rather to integrate with them, offering a new way to secure and coordinate industrial operations without intermediaries. With tools like ArkWriter for visual programming and PlutusLadder for contract deployment, Morley makes it possible to explore trustless machine coordination, industrial DeFi applications and decentralized control systems in a practical, accessible way.

At its core, Morley is about giving engineers and businesses the option to use blockchain where it makes sense, whether for improving auditability, securing machine logic or enabling new forms of automated collaboration.

Bridging Traditional Automation and Blockchain

To understand why this bridge needs to exist, it is essential to look at the pain points in today’s industrial automation landscape.

One of the biggest challenges in industrial automation is interoperability. Factories and industrial operations do not operate in isolation. They rely on global supply chains, distributed manufacturing networks and complex financing structures to function effectively. Yet most automation systems are designed for local execution. Machines can follow logic within their own environment, but they struggle to interact seamlessly across enterprises, geographies and financial systems.

Another major issue is trust and verification. Traditional automation depends on centralized oversight, proprietary software and manual auditing to ensure reliability. But this introduces vulnerabilities and inefficiencies. Counterfeit parts in supply chains, human errors in inventory management and fraudulent maintenance records all stem from a lack of automated, verifiable execution models.

Financing is another constraint. Industrial operations require capital investment in raw materials, energy and equipment. But factories and machines cannot participate in financial decisions. They cannot optimize supply chain purchases based on real time demand or self finance maintenance through decentralized liquidity pools. The financial layer of industrial automation is still entirely controlled by human intervention.

By introducing smart contracts and decentralized execution into automation, Morley aims to bridge this gap. Machines should be able to interact with blockchain based financial and governance systems to create more autonomous, verifiable and efficient operations.

Blockchain can enable real time financial settlements between machines and suppliers, programmable incentives for energy efficiency and decentralized oversight of industrial processes. A machine should not just follow an instruction. It should be able to deploy a smart contract (or interact with one), verify compliance and make autonomous economic decisions.

Practical Implications and Real World Use Cases

Practical Implications and Real-World Use Cases

Industrial automation has always been defined by execution. Machines follow instructions, carry out repetitive tasks and maintain precision within the limits of their programming. What they do not do is initiate actions beyond predefined logic, interact with external systems in a meaningful way or make financial or governance decisions. Automation in its current form is efficient but static. It is locked into closed networks, operating in environments where interactions with the outside world require human intervention.

Smart contracts introduce a new paradigm where machines do not just execute but also deploy, interact and adapt. A programmable logic controller running a factory line can do more than follow instructions; it can issue its own logic updates through an immutable on-chain record and ensure that every machine in the network follows the same verifiable rules without a centralized control point. A robotic system managing warehouse logistics can execute smart contracts for inventory tracking, autonomously adjusting supply orders based on real time demand, all without requiring human oversight. Industrial equipment can manage its own maintenance schedules by executing contracts that trigger predictive servicing when performance degradation is detected, automatically allocating funds and dispatching repair teams through a decentralized protocol.

Machine-to-machine finance introduces financial independence into automation. In traditional manufacturing, companies lease industrial robots for a fixed period, often paying in advance regardless of how much the equipment is used. A decentralized model allows machines to lease themselves dynamically based on actual usage, executing payments in real time through on-chain agreements. A bottling facility could temporarily lease additional robotic arms during peak production hours, paying only for the time and energy consumed rather than committing to a long term contract. Factory machines could pool their operational funds into decentralized liquidity reserves, staking tokens to finance new equipment upgrades or self repair programs. Industrial supply chains could tokenize raw materials, allowing manufacturers to buy, sell or hedge against material shortages using an automated pricing system that adjusts based on global availability.

Scaling industrial automation through blockchain requires infrastructure that can handle high frequency transactions without slowing down operations. Machines operate at speeds where even minor delays can disrupt entire workflows. Blockchain alone is not enough unless it can match the transaction throughput of industrial systems. Cardano’s Hydra enables high speed processing by creating dedicated channels that allow machines to execute operations off-chain while maintaining the security and finality of on-chain settlement. Midgard organizes industrial data into structured layers, ensuring that automation logic is stored efficiently and can be referenced instantly without introducing unnecessary computational overhead.

Interoperability between blockchain based automation and existing industrial systems is critical. Factories and power grids operate on decades old infrastructure. Introducing blockchain cannot require companies to abandon their established processes. Morley is designed to complement rather than replace traditional programmable logic controllers and ladder logic systems. Industrial equipment should be able to query blockchain based automation contracts without requiring a full migration to smart contracts. A factory that currently runs Siemens or Allen-Bradley controllers should be able to integrate Morley gradually with edge devices or network protocol interfaces, allowing blockchain based automation to handle supply chain finance, predictive maintenance and security while core operational functions remain intact.

Security and compliance are major concerns in industrial adoption of blockchain. Automation systems control high value assets, from energy grids to manufacturing plants. They require robust protections against cyberattacks, tampering and operational disruptions. Midnight introduces a privacy preserving layer that enables selective disclosure of industrial automation data. Manufacturing companies must protect proprietary processes while proving compliance with regulatory requirements. A pharmaceutical plant that deploys blockchain based automation for drug production cannot expose sensitive formulation details to the public, but regulators may require access to audit manufacturing conditions. Midnight allows granular access control, ensuring that data integrity is preserved without compromising industrial secrecy.

Blockchain in automation is not about replacing human oversight or introducing unnecessary complexity. It is about enabling machines to execute logic autonomously in a way that is verifiable, scalable and financially independent. The ability to interact with decentralized computation, finance and governance allows automation systems to evolve beyond static execution, giving them the tools to operate in a trustless, adaptive environment that enhances efficiency while maintaining security and control.

The Wildly Hypothetical and Future Vision

A decentralized industrial autonomous organization can redefine how factories, warehouses and logistics networks can operate. Machines that manufacture, transport and manage goods could collectively govern their own operations. Instead of a single company setting production schedules, an automated industrial DAO could allocate resources dynamically based on real world conditions. A supply chain that detects a sudden surge in demand for a particular product could autonomously increase production capacity, stake liquidity to secure additional raw materials and deploy contracts that adjust logistics routes in real time. Machines would not just execute tasks but vote on how industrial resources are distributed based on transparent, verifiable data.

Staking and voting mechanisms allow machines to make financial decisions. An autonomous assembly line could stake revenue in a decentralized liquidity pool to fund equipment upgrades. A self driving logistics fleet could vote on the most efficient energy sources, staking funds in decentralized energy grids that provide the lowest cost power based on fluid market conditions. Industrial robots could compete for work by staking their operational history, reliability metrics and energy efficiency scores, creating a trustless bidding system where automation services are allocated based on measurable performance rather than fixed corporate contracts.

Factories that finance their own expansion eliminate the need for centralized funding approval. A manufacturing facility that operates efficiently could autonomously reinvest profits into new machinery, purchasing additional production capacity without requiring boardroom discussions or human controlled treasury allocations. Decentralized finance allows factories to borrow against their production output, securing financing through tokenized revenue models that adjust dynamically based on real time demand. An industrial complex that produces semiconductors could tokenize its future supply chain, enabling investors to fund expansion in exchange for a share of verified production output recorded on-chain.

Programmable supply chains allow industrial markets to operate in real time. Instead of fixed pricing models that rely on long term contracts, an automated supply chain could adjust material costs dynamically. A sudden drop in copper prices could trigger an on-chain adjustment that immediately lowers procurement costs for factories relying on copper based components. A supply network could create dynamic incentives for suppliers who meet quality and delivery requirements, automatically penalizing late shipments and rewarding on time fulfillment with verified on-chain reputation scores.

Factories that self deploy their own sidechains introduce the idea that industrial operations can optimize themselves at a network level. Instead of relying on public blockchains for all transactions, a factory that produces high precision aerospace components could spin up a dedicated blockchain environment optimized for tracking supply chain quality, regulatory compliance and production efficiency. This private ledger could interact with the public blockchain when necessary, publishing only verifiable proofs of production quality while keeping sensitive intellectual property secure. A global network of interconnected factories could coordinate across these self deploying sidechains, ensuring that industrial production flows are not only efficient but also trustless and auditable.

The future of automation is not just making machines more efficient. It is enabling them to participate in economic and governance systems in a way that is secure, transparent and self sustaining. Machines that can execute financial transactions, optimize their own operations and collaborate in decentralized networks create an industrial landscape that is not just automated but intelligent. It is not just about reducing costs and improving efficiency. It is about shifting control from centralized entities to a distributed, verifiable system where machines operate within economic frameworks that are transparent, trustless and self regulated.

The Compilation Pipeline and ArkWriter

ArkWriter is a visual programming tool for Ladder Logic based smart contracts, designed to make writing, testing and deploying blockchain automation accessible. Built as part of the Morley ecosystem, it provides engineers and developers with an intuitive interface for creating machine logic that compiles directly to Plutus smart contracts on Cardano.

At its core, ArkWriter is about lowering the barrier to blockchain based automation and inspiring new and novel concepts. Instead of requiring deep knowledge of functional programming or Plutus, users can build logic visually, simulate execution and deploy contracts without leaving a familiar environment. Whether integrating industrial systems, securing machine driven transactions or exploring decentralized automation, ArkWriter provides a practical way to experiment, refine and deploy Ladder Logic based smart contracts.

The project is young, and much of its functionality is evolving. The goal is to make ArkWriter a powerful, open tool that grows with community input. Engineers, blockchain developers and automation specialists are invited to contribute ideas, provide feedback and help shape its future, whether through UI improvements, compiler enhancements or new integrations with existing automation systems.

ArkWriter is not about replacing traditional PLC programming but offering a new way to leverage blockchain where it makes sense. By combining the familiarity of Ladder Logic with the security and transparency of decentralized execution, it opens the door to trustless machine coordination, automated compliance and on-chain industrial applications.

For those interested in contributing, testing, or following ArkWriter’s development, the door is open. The best ideas often come from those who are curious.